DeFiChain Coin (DFI)

Table of Contents

About DeFiChain (DFI)

DeFiChain is the largest non-Turing complete blockchain and is based on Bitcoin.

The $DFI coin is an integral unit of account in DeFiChain. The DeFiChain Foundation issued roughly 600 million DFI on May 11th, 2020. The current circulating supply (with staking and liquidity mining) is available at DeFiChain Explorer.

Notable developments

- listing on Huobi Global [25 Jul 2022]

- launch of DeFiChain Bridge [Apr 2022]

- a fully decentralized bridge connecting DeFiChain with Binance’s BNB Chain to facilitate fast, secure, and low-cost transfer of liquidity between the two chains.

- entire process is decentralized and at no point does any one entity control the funds.

- DeFiChain’s DFI will act as the bridge token

- bridge’s cryptography relies on Binance’s Threshold Signature Scheme (TSS), which replaces all private key related commands with distributed computations. The libraries used have been certified and audited several times by Binance itself.

- 2021 – A Year Full of Great Achievements

Roadmap

DeFiChain already has decentralized trading functionality live & working, with lending and borrowing, as well as asset tokenization coming in Q3 2021. Soon you’ll be able to buy Tesla, Apple & more directly on the blockchain in a decentralized way.

Decentralized stocks, loans, dividends and more will soon be introduced to DeFiChain, making the DFI coin a strong investment with a lot of upside potential that can serve as a reliable, high yielding coin in any well-diversified crypto portfolio.

Technical Details

Most DeFi projects are built on the Ethereum blockchain, where applications run on so-called virtual machines. Unlike native blockchains, blockchains like Ethereum offer greater flexibility for developers. This flexibility, however, makes them more risky for decentralized financial applications.

Performing DeFi transactions on Ethereum takes more than 3,000 distinct steps — each with its own potential attack surface. On DeFiChain, just a few lines of code are enough, making transactions much more robust against potential attacks, and DeFiChain’s #NativeDeFi approach, more secure.

DeFiChain (a Bitcoin fork) is a blockchain dedicated to Native Decentralized Finance for Bitcoin. Native Decentralized Finance or #NativeDeFi means that the DeFi applications on DeFiChain are built directly on the blockchain, ensuring the highest level of security standards and a greater resistance to hacks.

Though DeFiChain is a Bitcoin fork, the blockchain’s consensus is ensured through a hybrid of Proof of Stake and Bitcoin’s Proof of Work. This means that everyone can participate in securing the blockchain and earn block rewards!

Ecosystem

DeFiChain Decentralized Exchange (DEX)

DeFiChain’s Decentralized Exchange (DEX) is the cornerstone of most decentralized financial applications in the DeFiChain ecosystem.

Being #NativeDeFi for Bitcoin, you can send actual bitcoins (BTC) to and from the Decentralized Exchange, and trade them for ETH, DFI, USDT, DOGE & many more digital tokens. This is a feature unheard of before in the crypto space.

Unlike most other decentralized exchanges, such as those built on Ethereum, DeFiChain’s DEX is not a website – which itself represents a centralized, vulnerable party – but rather an open-source, publicly available app that can be run by anyone. Because it’s decentralized, it also can’t be shut down by a centralized institution.

Staking and Liquidity Mining

Two of DeFiChain’s most important applications are Staking and Liquidity Mining.

Proof of Stake (Staking) is DeFiChain’s consensus algorithm and is comparable to Bitcoin’s Proof of Work (Mining). The difference is that Staking enables anyone to participate even without expensive mining rigs and vast amounts of electricity, to earn new DFI block rewards like bitcoin miners earn new bitcoins.

Liquidity Mining is not part of DeFiChain’s consensus algorithm, but serves the purpose of providing liquidity for the decentralized exchange. In return, liquidity miners get block rewards, making it a very lucrative endeavour and a win-win for everyone involved.

Notes

Project promotion efforts

2022

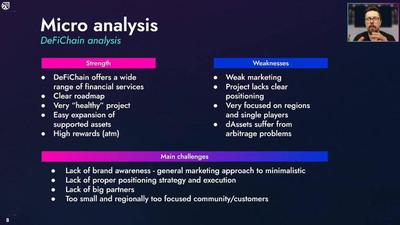

Detailed plans on how to position the project and increase its adoption rate:

- Community Funding Proposal: APOLLO MISSION - DeFiChain Accelerator

Reward token for Cake DeFi

DFI is the reward token for the Cake DeFi; a centralized DeFi platform based in Singapore. Most DeFi projects create their own tokens but Cake DeFi is unique in that the reward token is the gas token itself for the DeFiChain.

Resources

- Official Website.

- DeFiChain Analytics

- DeFiChain Explorer.

- Cake DeFi Learn and Earn

- defichain-masternode-monitor.com

- DFI Whale Alert