Celsius Network, Finblox, Hodlnaut, Vauld, and Zipmex have become distressed platforms. Are other platforms safe?

Consolidating releases from various platforms

Image by Clker-Free-Vector-Images from Pixabay

Image by Clker-Free-Vector-Images from PixabayTable of Contents

Distressed platforms (covered on this website)

Ths list below keeps growing and I am half expecting more to be added as time goes by…

I observed a familiar pattern of platforms first providing reassurances to clients that their business operations were doing fine and they had no liquidity issues, no exposure to 3AC or LUNA or UST etc; before announcing withdrawal halts out of the blue.

I didn’t expect Hodlnaut, which had received in-principle approval of license from Monetary Authority of Singapore (MAS) in March 2022 to have problems.

This makes me highly skeptical of any reassurances coming from all the platforms covered on this site.

In a statement released in August 2022, MAS clarified that Payment Services Act (PSA) licensing involves regulation around money laundering and terrorism financing risks as well as technology risks.

Firms are not subject to risk-based capital or liquidity requirements, nor are they required to safeguard customer money or digital tokens from insolvency risk.

“MAS has been continually reminding the general public that dealing in cryptocurrency is highly hazardous”

“Not only are the values of cryptocurrencies extremely volatile, customers’ monies are not protected under the law.”

Summary table:

| Distressed Platform | Announcement Date |

|---|---|

| Celsius Network | 13 Jun 2022 |

| Finblox | 16 Jun 2022 |

| Vauld | 04 Jul 2022 |

| Zipmex | 20 Jul 2022 |

| Hodlnaut | 08 Aug 2022 |

Celsius Network pauses withdrawals, swaps, and transfers [13 Jun 2022]

(13 June 2022) Initial announcement:On 13 Jun 2022, at around 10am Singapore time, Celsius announced it was pausing all withdrawals, swap, and transfers between accounts.

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

“Acting in the interest of our community is our top priority. In service of that commitment and to adhere to our risk management framework, we have activated a clause in our Terms of Use that will allow for this process to take place. Celsius has valuable assets and we are working diligently to meet our obligations.”

“We are taking this necessary action for the benefit of our entire community in order to stabilize liquidity and operations while we take steps to preserve and protect assets. Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to our customers.”

There is speculation that Celsius Network is having liquidity issues to cover interest, customer withdrawals.

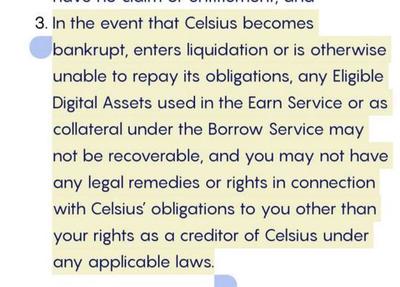

The above excerpt from the ‘Terms of Use’ agreement is also worrying.

I got worried about how safe my funds are on other platforms. Listing down statements from platforms that are covered on this site that I managed to find.

(16 June 2022) FAQ page creationCelsius has created a FAQ page to address some of the questions from concerned users.

(13 July 2022) Filing for Chapter 11 reorganizationCelsius has voluntarily filed petitions for Chapter 11 reorganization

- A total of eight Celsius-related entities are declaring bankruptcy.

- $1.2B Hole in Balance Sheet

- Celsius said it had $167 million in cash “to support certain operations during the restructuring process.”

- more than 100,000 creditors in its petition. The petition names Pharos USD Fund SP and Pharos Fund SP as its largest unsecured creditor, with an unsecured claim of approximately $81 million. Other named creditors include ICB Solutions, The Caen Group LLC, Alameda Research, B2C2, and Covario AG, among others.

- Chapter 11 bankruptcy allows a company to continue operations while meeting its obligations to indebted parties. This is usually executed by proposing a plan of reorganization to be approved by creditors and overseen by a legal team.

- Youtube video released by Celsius explaining Chapter 11 can be found here

(22 November 2022) Email from Celsius The court has approved Celsius' motion to set the bar date, which is the deadline for all customers to file a proof of claim. The bar date has been set for January 3, 2023.

Customers should expect to receive a notice regarding the bar date from Celsius' claims agent, Stretto, via email, physical mail for those customers with an address on file, as well as through a notification in the Celsius app. The notice will also include instructions on how to file a proof of claim.

Finblox limits withdrawals, pauses rewards and referral payouts [16 Jun 2022]

(14 June 2022)After the Celsius announcement, Finblox sent an email on 14 June 2022 to reassure users that all was well.

read the email from Finblox after Celsius' announcement

Dear Finblox Community,

We are well aware of current market conditions and the fact that some businesses are being scrutinized for their business methods. Trust and security have always been key to our business strategy and would like to ensure you that despite all this, Finblox remains unaffected.

We are a young company with strong fundamentals and conservative risk management. While dealing with established institutions and partners, we do due diligence which includes risk analysis using on-chain monitoring technologies that uncover platform vulnerabilities and fund structures. We’re forward-thinking, but we’re also judicious about broadening our reach and network.

We are committed to providing world-class service and are happy to answer any queries you may have. Thank you again for your confidence in us, and we pledge to continue to earn your trust through utmost transparency.

Best,

Peter and Dmitriy

Co-founders of Finblox

The media soon started reporting that Three Arrows Capital (3AC) was potentially facing insolvency. It appears Finblox might have made uncollateralized loans to 3AC.

To evaluate the situation, Finblox sent another email saying they will:

- pause reward distributions on the Finblox platform for all users

- change withdrawal limits (500 USD equivalent per day, up to a maximum of 1500 USD equivalent per month) for all levels of users

- delay referral program and deposit rewards

- disable creation of crypto addresses for newly registered users

Expand for 16 June 2022 (8pm SGT) email contents

To our Valued Users,

We have been closely monitoring market conditions and numerous media reports regarding a prominent institutional borrower, Three Arrows Capital (3AC) - who is also an investor in Finblox.

We have been cooperating with over 8 partners and protocols, including 3AC, to generate yields and spread the risk as evenly as possible. Based on currently available information and our priority to maintain the integrity of the platform - we have decided to take the following actions while pursuing all available options to evaluate the effect of 3AC on the liquidity, and ensure fair treatment of all user assets in the system:

- Pause reward distributions on the Finblox platform for all users

- Change withdrawal limits (500 USD equivalent per day, up to a maximum of 1500 USD equivalent per month) for all levels of users

- Delay referral program and deposit rewards

- Disable creation of crypto addresses for newly registered users

This set of actions is a necessary move in such a highly volatile market and we believe should help us and our community to manage the effect.

Ultimately, Finblox will do everything in its power to protect our users’ funds and reinstate our services in full. We will provide you with updates and inform you of any new developments as soon as possible, and do all that we can to avoid further impact on our users.

Thank you for your understanding, The Finblox Team

I tried withdrawing 499 USDC via BSC network on three occasions (17-19 June 2022) and all the transactions went through within 30 mins without any hitches.

(20 June 2022) Email update:Expand for 20 June 2022 email contents

To our Valued Users,

Following up on our previous email from a few days ago, we would like to keep you posted on the current developments and the course of action we are taking.Here are some of the steps we are currently taking to deal with the situation:

- We are in the process of consolidating all users’ funds to evaluate the current effects of the unfolding situation with the market. This includes withdrawing funds from all partners regardless of the amount to minimize our users’ further exposure to current market conditions. We will update you further on how the market-driven situation has affected users’ account balances as soon as we are in a position to do so.

- We are actively pursuing all available options (including legal recourse) to address the liquidity situation that has arisen due to the recent developments around Three Arrows Capital (3AC) and the market in general.

- We are also investigating and assessing a range of possible scenarios and the potential effects that these scenarios could have on the liquidity of our Users’ accounts, including the time frame in which normal business operations and withdrawals (including the restoration of daily withdrawal limits) might be resumed, which we are endeavouring to accomplish as quickly as possible.

Whilst we do so, we would appreciate your patience and support as we continue to work towards a constructive and fair solution for everyone.

As another note on this, we deeply apologize for the current level of service and support Finblox is able to provide as a consequence of recent developments. The team is working harder than ever to find a solution.

Thank you for your understanding, The Finblox Team

The one positive update received is that Finblox’s treasury was not entrusted to Three Arrows Capital (3AC).

Expand for 24 June 2022 email contents

Dear Finbloxers,

We appreciate your patience in waiting while we have been working hard in the background to assess various options and the potential impact of each option on fund recovery, liquidity, and the restoration of normal operations of the platform.

Over the past week, we have sent multiple demands to Three Arrows Capital (3AC) demanding repayment of the entire loan balance to which we have yet to receive any response. In the meantime, our team has briefed an external legal counsel to provide specialist legal support.

We are also aware of reports that 3AC may have been managing the treasuries of several decentralized finance protocols that it backed. We categorically confirm that Finblox does not have any treasury arrangements with 3AC.

We intend to activate one or more of the following in the shortest time frame possible:

- Increasing withdrawal limits

- Re-enabling new deposits

- Restoring yield reward generation

We will provide an estimated timeline of the above as it becomes available. We know the last few days have been challenging for everyone affected. The recent events have come as a shock not only to us the Finblox team but also to the wider community. Rest assured, the team has been hard at work and taking active steps in the background, and believe we can come out even stronger afterward.

Thank you for your understanding and patience, The Finblox Team

Key points:

- All users who hold stablecoins (USDC, BUSD, DAI, USDT, XSGD, XIDR) will have a percentage of their individual stablecoin holdings reserved from withdrawal, but will be able to access their non-reserved portion.

- non-stablecoins are not impacted and are available for withdrawals under current limits.

- Reserved assets will not earn rewards until further notice.

Expand for 28 June 2022 email contents

Dear Finbloxers,

We would like to share that since our last announcement, we’ve already re-enabled new deposits and the creation of new asset addresses. Here are other updates that we are able to share at this moment:

- All users who hold stablecoins (USDC, BUSD, DAI, USDT, XSGD, XIDR) will have a percentage of their individual stablecoin holdings reserved from withdrawal - but will be able to access their non-reserved portion.

- The percentage of reserved stablecoin holdings is based on factors such as:

- The user’s balance on 15 June 2022

- The percentage of their asset contribution to the entire pool

- The portion of that asset that is affected by illiquidity at this moment

- To calculate the reserved percentage, we applied the following criteria:

- Withdrawals initiated before the end of 15 June 2022 (23:59:59 UTC) that were not processed (failure or rejection) will be excluded from this reserve and are still available for withdrawal.

- Any assets deposited after 15 June 2022 (23:59:59 UTC) will be excluded from reserve and are still available for withdrawal according to the new limitations imposed.

- We are exploring options including restoring withdrawal limits to their former levels and enabling reward generation. We hope to have a timeframe available soon, as it depends on numerous factors, including market conditions and liquidity. Please note that non-stablecoins are not impacted and are available for withdrawals under current limits.

- Reserved assets will not earn rewards until further notice.

The Finblox Team has been working hard in the background, and we will continue to work our hardest to resolve the situation and support you, our users.

Thank you for your understanding and patience. The Finblox Team

Key points:

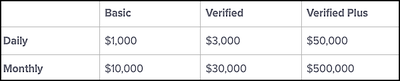

- withdrawal limits improved. Complete details can be found on the withdrawal limits article

Withdrawal limits as of 24 August 2022 - daily limits refresh every day at 00:00 UTC, while monthly limits refresh every first calendar day of the month at 00:00 UTC.

- note that effective 3 August 2022, users must pay a fixed fee for each withdrawal in order to cover the fees associated with transferring cryptocurrency out of their Finblox account. Details on withdrawal fees available here

- referral program restored

- honoring payouts that are owed.

Expand for 30 June 2022 email contents

We’re pleased to inform you that we’ve made progress towards increasing your withdrawal limits.

Starting tomorrow, 1 July 2022 - if you have completed the “Verified” or “Verified Plus” level of identity verification, you will be able to withdraw up to US$3,000/day, for a maximum of US$30,000/month. And, by 5 July 2022 - if you have completed the “Verified Plus” level of identity verification, you will be able to withdraw up to US$50,000/day, for a maximum of US$500,000/month.

Another step we are taking towards resuming usual operations is to restore yield generation on the following assets from 1 July 2022 (except for assets that are marked as reserved funds in the users’ accounts):

We look to gradually increase the existing yields, provided that they are sustainable with market and platform conditions. We will also be resuming our referral program in full and honoring all payouts that are owed. Finally, on 1 July 2022 - Finblox will be implementing dynamic yield rates (flexible at our discretion) subject to a 2-day notice provided to all users before each change. The team is committed to making improvements to the product which would bring a higher level of transparency to some aspects of the system, which will be announced separately.

As a relatively young platform in the space, we were deeply impacted by negative market events at an early stage. We will do everything in our power to make things right, and better improve the user experience going forward. We truly appreciate our users’ support during this crisis.

All the best, The Finblox Team

Key points:

- Three Arrows Capital (3AC) has so far failed repayment of the loan balance to Finblox, despite numerous demands from Finblox and its legal counsel

- As 3AC has entered into liquidation in the British Virgin Islands, Finblox has been advised by their legal counsel that the process may take many months

- Finblox continues to explore all other options for asset recovery from 3AC during this time, including any possible legal recourse

- Finblox will provide an update on the progress on the first week of every month

- Finblox is not generating any yields or profits from the reserved funds that are not accessible to date

Key points:

- liquidators of 3AC are pursuing enforcement of the main proceedings in jurisdictions where they believe assets of 3AC may be located

- Finblox is in contact with liquidators and exercising the rights available as creditors of 3AC in the best interests of Finblox clients with affected funds

- liquidation proceedings may take a significant amount of time until they are completed

- Finblox is seeking other options to gradually reduce the amount of reserved funds, including allocating a portion of future revenue and profits towards the cause

- The next update will be on 5 September, 2022.

Key points in email received:

- Liquidators of 3AC continue to pursue enforcement of bankruptcy proceedings in jurisdictions where assets of 3AC may be located, with some procedural success

- Finblox continues to exercise the rights available to Finblox as creditors of 3AC in the best interests of users with affected funds, and remain in direct contact with the liquidators.

- Recovery efforts continue in the form of legal proceedings against 3AC, and also alternative options related to the growth of the Finblox ecosystem.

Key points in email received:

- finished converting reserved funds to FBX Token for all eligible users who have submitted the request.

- Finblox plans to allocate a significant portion of its own future operational reserve within 1-2 years, subject to possible market recovery and platform growth, to reduce the amount of reserved funds for the affected users.

Vauld suspension of all withdrawals, trading and deposits [4 Jul 2022]

Useful resource: Vauld Restructuring Announcements and FAQs

(16 Jun 2022) Email from Vauld:Vauld claimed to have no exposure to Celsius or Three Arrows Capital

Expand for 16 June 2022 email contents

Hey there,

We understand that these are trying times for crypto investors, but Vauld continues to operate as usual despite volatile market conditions.

We have always maintained a balanced and conservative approach to liquidity management. Bull and bear runs are inevitable in the crypto market, and we deploy fundamentally strong strategies that account for these cycles.

We do not have any exposure to Celsius or Three Arrows Capital, and we remain liquid despite market conditions. Over the last few days, all withdrawals were processed as usual and this will continue to be the case in the future.

We believe that such difficult market conditions will eventually give rise to a new wave of innovation and growth, and we are laser-focused on putting our heads down and building for that future.

We remain committed to enabling you to build wealth.

Best, Darshan Bathija, Co-Founder and CEO at Vauld.

Despite claiming last month that Vauld had no exposure to Celsius or 3AC, they released a corporate statement today announcing the suspension of all withdrawals, trading and deposits on the Vauld platform with immediate effect.

Expand for Corporate Statement on 4 July 2022

#1. The Vauld management wishes to inform that we are facing financial challenges despite our best efforts. This is due to a combination of circumstances such as the volatile market conditions, the financial difficulties of our key business partners inevitably affecting us, and the current market climate which has led to a significant amount of customer withdrawals in excess of a $197.7 m since 12 June 2022 when the decline of the cryptocurrency market was triggered by the collapse of Terraform Lab’s UST stablecoin, Celsius network pausing withdrawals, and Three Arrows Capital defaulting on their loans.

#2. As such, we have considered that it would be in the best interests of stakeholders to take immediate action in the circumstances. In furtherance of this, we have engaged the services of Kroll Pte Limited as our financial advisor, as well as Cyril Amarchand Mangaldas and Rajah & Tann Singapore LLP as our legal advisors in India and Singapore respectively.

#3. Our management remains fully committed to working with our financial and legal advisors to the best of our abilities to explore and analyse all possible options, including potential restructuring options, that would best protect the interests of Vauld’s stakeholders.

#4. We are currently in discussions with potential investors into the Vauld group of companies. We intend to apply to the Singapore courts for a moratorium i.e. a suspension of the commencement or continuation of any proceedings against the relevant companies so as to give us breathing space to carry out the proposed restructuring exercise.

#6. We are confident that, with the advice of our financial and legal advisors, we will be able to reach a solution that will best protect the interests of Vauld’s customers and stakeholders.

#7. In the meantime, we have made the difficult decision to suspend all withdrawals, trading and deposits on the Vauld platform with immediate effect. We believe that this will help to facilitate our exploration of the suitability of potential restructuring options, together with our financial and legal advisors. We seek the understanding of customers of the Vauld platform that we will not be in a position to process any new or further requests or instructions in this regard. Specific arrangements will be made for customer deposits as may be necessary for certain customers to meet margin calls in connection with collateralised loans.

#8. Further updates on material developments will be provided at the appropriate juncture. We seek your understanding and patience in the meantime. Should you have any queries, please submit them at enquiries@vauld.com. We will endeavour to address them as soon as practicable.

Yours sincerely, Darshan Bathija Chief Executive Officer

4th July 2022

There is no point #5 in the Corporate Statement. Not sure if it was a typo mistake or removed before publication.

(8 Jul 2022) filed for a moratorium in the Singapore Courts: Key points:

- owes creditors US$402 million, with $363 million owed to retail individual investors

- owes a total of US$125 million to its 20 largest unsecured creditors

- three creditors are owed more than $10 million each, with the largest owed $34 million

Key points from email:

- On Friday, 8 July 2022, Defi Payments Pte Ltd filed for a moratorium in the Singapore Courts according to section 64 of the Insolvency, Restructuring and Dissolution Act 2018.

- A moratorium is granted for 30 days and it may be sought and granted for a longer duration. Filing does not mean that Vauld is winding up or shutting down the company. Instead, they are asking for time to formalize a restructuring strategy so that they can resume operations.

- Reasons for filing a moratorium

- mismatch of assets and liabilities of Defi Payments Pte Ltd where the main contributing factors to the gap have been mark to market losses on BTC, ETH, and MATIC trades and exposure to UST.

- mismatch of tenure where Vauld committed a significant proportion of their AUM towards loans with a tenure of another 3-11 months that can’t be recalled early.

- On a group level, Vauld has assets worth ~$330 million and liabilities worth ~$400 million at this time.

- Top priority is to complete the due diligence process with Nexo with regards to acquisition offer by Nexo

More than 75% of creditors were in favor of the application for moratorium.

(7 Nov 2022) Moratorium extension:The Court granted an extension for the moratorium until 20 January 2023.(27 Dec 2022) Update on discussion with Nexo:To provide a very brief summary, our discussions with Nexo have unfortunately not come to fruition. We are, however, pleased to inform you that we have managed to identify and reach out to a number of reputable fund managers who are willing to work with us on a proposed restructuring plan

Zipmex pauses withdrawals of all fiat and crypto [20 Jul 2022]

Just when it felt the contagion was subsiding, another platform announced it was suspending all fiat and crypto withdrawals :(

(20 July 2022) Initial announcement:Expand for email announcing withdrawal pause on 20 July 2022

Due to a combination of circumstances beyond our control including volatile market conditions, a series of black swan events in the industry, and the resulting financial difficulties of our key business partners we have considered that in order to maintain the integrity of our platform, we would be pausing withdrawals until further notice. We apologize and appreciate your patience in the meantime.

At Zipmex, the security of our customers is our number one priority. As such, we strive to provide the most secure platform possible. For further enquiries, please do get in touch with our Customer Support Team over Live Chat - this is available 24/7.

Team Zipmex

On Twitter:

(21 July 2022) Message from Group CEO Marcus Lim:Due to a combination of circumstances beyond our control including volatile market conditions, and the resulting financial difficulties of our key business partners, to maintain the integrity of our platform, we would be pausing withdrawals until further notice.

— ZIPMEX (@zipmex) July 20, 2022

Expand for email contents

Dear Zipmex customer

Firstly, I would like to sincerely apologise for the panic that has been created by the sudden announcement of us pausing withdrawals. I understand that many of you are concerned and rightly so.

I would like to be completely transparent with all of you who have put your faith in Zipmex, whether you’ve been a customer for a long time, or only just started with us recently.

We’ve been facing some liquidity issues with counterparties that Zipmex had assets with. The tokens affected are BTC, ETH, USDC and USDT that were specifically in ZipUp+.

As such we had to halt withdrawals while we recoup the rest of our funds.

Regulators have been informed and are aware of our movements, as well as our investors.

At the moment there are many users trying to use the service at the same time. This along with the liquidity issues cited above has therefore required trading to be suspended for the moment while we assess the situation.

As the CEO of the Company, I take this opportunity to once again apologise for the situation and please rest assure that we are exercising our best ability to ensure that your assets are safe with us.

At Zipmex, security of your assets and your peace of mind are our number one priority.

Thank you for your cooperation and understanding

Please stick to our official line of communications for further information.

For further enquiries, please do get in touch with our Customer Support Team over Live Chat - this is available 24/7.

Yours sincerely, Marcus Lim, Group CEO, Zipmex

Key points:

- trade wallet withdrawals were re-enabled for Global and Singapore users.

- withdrawal still paused for clients who have assets in their Z-wallet (subscribers to ZipUp+)

- as of 21st of July, Zipmex are currently owed a net amount of:

- $48 million USD by Babel Finance

- $5 million USD by Celsius Network

- intention to write off loan to Celsius Network against Zipmex’s own balance sheet.

- for the moment, Zipmex continues to operate the Trade Wallet, NFT platform, and other products as normal

Expand for email contents

Dear Zipmex customer,

Just now, trade wallet withdrawals were re-enabled for our Global and Singapore users.

We’re working diligently with our partners so as to re-enable our withdrawal functionality to all users who have assets in their Z-wallet (subscribers to ZipUp+).

ZipUp+ (the Zipmex CeFi Solution)

Due to current macroeconomic conditions and the recent fallout in the crypto space from recent events concerning Celsius Network, 3AC, Babel Finance, and others, Zipmex’s CeFi product has recently been exposed to defaults from two of our institutional borrowers. Since the beginning of this year, we have been able to retrieve the majority of these funds and assets historically deployed with our various partners and have been actively working to resolve the situation.

Up to this point in time, our operations were not materially affected, and we have in place a viable path to resolution. On Wednesday evening, platform-wide withdrawals were paused in order to protect our customers and to ensure our products remain viable and safe.

The size of our exposure to Celsius Network and Babel Finance has been grossly exaggerated. We would like to correct some misleading information that is currently circulating in the press.

As of the 21st of July, we are currently owed a net amount of:

- $48 million USD by Babel Finance

- $5 million USD by Celsius Network

Recovery in progress

Zipmex remains committed to transparency. Our customers and our community are and always will be our priority.

When the news broke in Thailand on Wednesday, we were already in discussion with Babel Finance on ways to resolve this liquidity situation. These discussions are ongoing. We are currently evaluating our options, based on the outcomes of these negotiations. Dialogue between Zipmex and Babel Finance remains open and we are committed to a solution. Our loan to Celsius Network was minimal and we intend to write off this loss against our own balance sheet.

While ZipUp+ has received much press attention due to the high APY offered, it is not central to our exchange operation, NFT platform, WEB3, and Metaverse projects. We are not a predominantly CeFi company. We are a “digital asset platform” and as such remain invested and operational in a multitude of other blockchain-based projects.

What happens next?

Because the negotiations have not yet been concluded, we don’t have a cut-and-dried answer yet. Zipmex is exploring all available channels. This includes capital raises and internal restructuring. For the moment, Zipmex continues to operate the Trade Wallet, NFT platform, and other products as normal.

Let us reiterate:

Withdrawals using the Zipmex Trade Wallet are not affected.

We’re working around the clock to address the liquidity issue so we can re-enable withdrawals from users’ ZipUp+ wallets as soon as possible. We apologize for the uncertainty and frustration this event has caused.

We will continue to engage in open dialogue with our community, local regulators across all our markets, and all impacted parties. Our users are a priority and we are striving to restore all functionality to the platform while being as transparent as possible.

We thank you for your patience while we are working to resolve this issue and for your continued support.

We’re here 24/7 for support, please let us know if you need any assistance. Please note that we may be experiencing higher than usual levels of traffic and may take some time to respond.

Zipmex Team

Official announcement here.

“On 22 July 2022, our solicitors in Singapore, Morgan Lewis Stamford LLC, filed five applications under Section 64 of Singapore’s Insolvency, Restructuring and Dissolution Act 2018 on behalf of several of the Zipmex Group’s entities. We are seeking global moratoriums to prohibit and restrain the commencement or continuation of proceedings against the companies for a period of up to six months.”

The entities that have sought the moratorium relief in the applications are:

- Zipmex Asia Pte Ltd

- Zipmex Pte Ltd

- Zipmex Company Limited (incorporated in Thailand)

- PT Zipmex Exchange Indonesia (incorporated in Indonesia)

- Zipmex Australia Pty Ltd (incorporated in Australia)

Zipmex emphasizes that:

- This helps protect Zipmex against third party actions, claims, and proceedings while it is active, and enables the team to focus all efforts on resolving the liquidity situation, without having to worry about defending potential claims or adverse actions while doing so.

- It is important to note that a moratorium is not a liquidation of any company, and there is no significant status change from the last update.

- Zipmex continues to operate the Trade Wallet, NFT platform, and other products as normal, and there is no planned interruption to service of the same.

The official statement is very lengthy. Information shared that interests me are:

- Zipmex is gradually releasing Z Wallet tokens and crediting them into Trade Wallet, starting with these five tokens: Solana (SOL), Ripple (XRP), Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH).

- Zipmex has had discussions with multiple reputable, and large-scale investors and has signed a Memorandum Of Understanding (MOU) with two investors.

- development of ZMT is moving ahead in accordance with announced road-map

Official statement from Zipmex. Key points:

- On 15 August 2022, the Singapore Court considered and rendered its decision to allow all 5 of the Zipmex entities to conduct its restructuring in Singapore. - It also granted the extension of the moratorium relief requested by Zipmex. The extension period will be effective until 2 December 2022 which means that the 5 Zipmex entities will have a temporary protection from any legal proceedings or actions by any creditors under the Singapore Court’s jurisdiction

- Court directed that Zipmex shall convene a town hall style meeting with its creditor and customer base within 1 month from the date of the Court’s decision.

Zipmex is re-enabling transfers from users’ Z Wallets to Trade Wallets on Thursday 25th August 2022 for ZMT first.

All users will be able to access all of their ZMT at their own convenience by transferring the tokens through Zipmex’s exchange website.

Once transferred to the Trade Wallet, users will be able to withdraw assets as per usual.

(21 November 2022) Filing for moratorium extension: Zipmex Group has filed applications for the extension of the moratorium until 2 April 2023 to support the restructuring efforts (pending consideration by the Singapore court).

Hodlnaut halts all withdrawals, token swaps and deposits with immediate effect [8 Aug 2022]

On 8 August 2022 evening, Hodlnaut announced it will be halting withdrawals, token swaps and deposits with immediate effect.

I learned about the news from social media. As of 8 August 2022 11:00pm, I have not received any communication from Hodlnaut via email.

Key points:

- informed the MAS of intention to withdraw licence application.

- Hodlnaut is no longer providing regulated digital payment token (DPT) services, ie token swap feature. For the avoidance of doubt, Hodlnaut will also cease all borrowing and lending services.

- all social media platforms will be turned off except:

- email (support@hodlnaut.com)

- Twitter (@hodlnautdotcom)

- Hodlnaut Telegram (https://t.me/hodlnaut)

- for any enquiries, email support@hodlnaut.com

- updates will be at https://www.hodlnaut.com/blog/news alongside regular email updates to users.

- next update will be on Friday, 19 August 2022.

This is contrary to all the reassurances they have been giving to clients since June 2022. See below for history of updates I consolidated before the halt announcement on 8 August 2022.

Collection of reassurances to clients from June 2022 to before halt announcement by Hodlnaut

(13 Jun 2022) Email reassurance:

On current market conditions

Hodlnaut practices sound risk management policies. Despite the current volatile conditions, all Hodlnaut products & services remain unaffected and are fully operational, including interest payouts, token swaps, deposits and most importantly, withdrawals. We take risk management in the company very seriously and utmost responsibility to customer assets and stakeholders is always at the top of our priority.

(16 Jun 2022) Shared on Discord:

“We would like to reassure all users of the Hodlnaut platform that we do not have any exposure and loans with Three Arrows Capital or Celsius Network. All withdrawals and systems are as per normal. User experience and safety of assets are and remain our top priority.”

(20 Jun 2022) Updates by CEO on Twitter:

1/

— JT (@jt_hodlnaut) June 19, 2022

Some updates on @hodlnautdotcom and hopefully to the CeFi borrowing and lending space and Contagion risks

Outflows, we have seen 150M of user withdrawals in the past 2 weeks. at current market prices, that is a net outflow of 35% of AUM

Full statement here which includes a useful FAQ

Key points:

- Hodlnaut aiming to avoid a forced liquidation of assets as it is a suboptimal solution that will require Hodlnaut to sell users’ cryptocurrencies such as BTC, ETH and WBTC at current depressed asset prices.

- Hodlnaut believes that undergoing judicial management would provide the best chance of recovery. Therefore as of 13 August 2022, Hodlnaut Pte Ltd filed an application with the Singapore High Court to be placed under judicial management.

Full statement here which includes a useful FAQ

Key points:

- Hodlnaut’s present financial circumstances are a result of losses suffered by Hodlnaut’s Hong Kong subsidiary during the TerraUSD crash, unusually high volumes of withdrawals, the overall decline in cryptocurrency prices from their 2021 highs and issues relating to certain user(s) who have deposited substantial amounts of cryptocurrency with Hodlnaut.

- all open term interest rates reduced to 0% APR from 22 August, 5pm (GMT+8)

- since withdrawals were halted, Hodlnaut has laid off 80% of employees (being approximately 40 employees), in order to reduce the company’s expenditure

- application to be placed under Interim Judicial Management will tentatively be heard on Monday, 22 August 2022 at 2:30pm (GMT+8).

- Hodlnaut Pte Ltd’s Judicial Management application will also be running in parallel. The next case conference for the Judicial Management application has been fixed for hearing on 30 August 2022 at 10:00am (GMT+8).

- Hodlnaut does not have any secured creditors.

It was reported in media that:

- Hodlnaut disclosed, as of 8 August 2022, an outstanding liability of S$391 million (US$280 million), against assets of S$122 million (US$87.3 million) in court documents; a shortfall of US$193 million

- Hodlnaut parked some $317 million in UST, the stablecoin which failed, causing losses of $189.7 million

- Hodlnaut is looking into “limited exits” for its users at 25 cents on the dollar, calling it a “better option” than liquidation. The firm believes that the latter strategy will take relatively longer, and result in lower returns.

- Hodlnaut has made it clear that it is not in liquidation, and that it foresees stable future returns.

ChannelNewsAsia reported that the police are investigating Hodlnaut and its directors for suspected cheating and fraud offences.

In a circular on Nov 11 from EY - Hodlnaut’s interim judicial managers - it said that prior to EY’s appointment, about 25 per cent of Hodlnaut’s assets were deployed on centralised exchanges.

About 71.8 per cent of these digital assets deployed by Hodlnaut on centralised exchanges were held with FTX, with an estimated market value of S$18.47 million.

Before the announcement of FTX’s collapse, the interim judicial managers attempted to withdraw the assets from FTX but it could not be processed. When EY contacted FTX several times to escalate the matter, no responsed was received except for an automated reply.

Updates from other platforms

Cake DeFi

Cake DeFi released a blog post on what sets them apart from Celsius.

Key points:

“First and foremost, we want to reassure our customers that the current market conditions have little or no impact on Cake’s daily business.”

“As a Singapore-based fintech company, we have to ensure clear asset segregation whereby customers’ assets are kept separate from the company’s operating accounts. Simply put, our users have full control, full ownership and full authority over their funds.”

DeZy

(14 Jun 2022) DeZy shared on Twitter:

(17 Jun 2022) Further update with an email:Wild days in the market. Understandably some of our customers have asked us whether we are impacted by the ongoing news related to Celsius.

— DeZy (@DeZyFinance) June 14, 2022

First and foremost, no. All systems are DeZy are operating smoothly and without interruption. All funds are safe.

But lets go deeper 🧵

Key points:

- as a precaution, on Monday the 13th of June 2022, DeZy withdrew all funds from all yield protocols into their multi-sig vault with Copper.

- DeZy has never and will never trade with customer assets or engage in any kind of leveraged activity

- users continue to earn yield at 5.5% APR with DeZy. Yields are currently coming directly from the DeZy treasury. This is a temporary measure.

- there is no change in withdrawal limits which is S$20,000 per transaction.

read the full email from DeZy on 17 June 2022

We are writing to inform you that all systems at DeZy are functional and your funds are safe and accessible.

June has been a trying month in terms of both macro and crypto market conditions. We are happy to report that we continue to successfully navigate this situation due to the risk mitigated and customer-first decisions we have made since day one.

Update to DeZy customers

Recent news related to Celsius, 3 Arrows Capital and other ongoing market movements have compelled us to take proactive steps to ensure safety and accessibility of all customer funds.

After closely monitoring market conditions, on Monday the 13th of June 2022 we withdrew all funds from all yield protocols we operate with into our multi-sig vault with Copper.

This step was taken not as a reflection of our trust in the sources of yield we work with but rather as an extraordinary measure of precaution to ensure customer safety.

We made this decision for several reasons:

- To preempt potential contagion in the industry given the size of entities involved in recent events.

- In times of uncertainty, we have prioritised prudence. This is our responsibility to each and every one of you.

We were able to do this seamlessly as DeZy has never and will never trade with customer assets or engage in any kind of leveraged activity.

Do I still get returns on my capital?

You will continue to save at 5.5% APR with DeZy. Your yield is currently coming directly from our treasury. This is a temporary measure we have undertaken due to the circumstances the markets are undergoing.

We will inform our customers when funds are redeployed. Your yield will continue to generate in the interim.

Can I withdraw?

Yes, of course. There is no change in withdrawal limits which is S$20,000 per transaction.

We understand, you’re anxious and feel safer with your money in the bank. One of the tenants of our service is that your money is indeed yours. Withdrawals are usually processed in under 24 hours.

Due to increased activity flowing through industry infrastructure intermittent delays in withdrawals may be experienced but this is not in any way related to liquidity issues with DeZy or with StraitsX (our fiat on and off ramp partner). Per the above, all funds have already been removed from protocols.

We are working with StratisX to ensure that withdrawals flow smoothly.

Thank you for trusting us with your savings journey.

Our team at DeZy remains committed to building safe and user friendly access to higher returns. If you have any questions feel free to reach us directly at support@dezy.sg or jump into our discord to speak with the team.

We hope to continue to be a safe haven for you in a tumultuous market.

Best, The DeZy Team, dezy.sg

(4 July 2022) Dezy clarifies it has no exposure to Vauld which announced suspension of certain operations.

“On the 13th of June 2022 we withdrew 100% of funds from all sources of yield as an extraordinary step in the interest of protecting users.”

read the full email from DeZy on 4 July 2022

We are writing to inform you that all systems at DeZy are functional and your funds are safe and accessible.

Update to DeZy customers

Firstly and most importantly, all customer funds remain 100% safe and available with Dezy.

We are not pausing, withholding or in any way restricting our services.

We have just received notice from Vauld that they have halted services.

As our customers know, Vauld has been one of our sources of yield. As was reported to our customers, on the 13th of June 2022 we withdrew 100% of funds from all sources of yield as an extraordinary step in the interest of protecting users.

It was and is our view that market conditions remain unstable and so we took that step specifically to avoid a situation like this.

We have and will continue to pay yield generated by our customers.

We have and will continue to pay all rewards earned by users.

In summary:

Our services continue to operate.

Our services are not being halted.

Our services have never been halted.

No customers have lost money via Dezy.

100% of customer funds remain in our vaults in Copper and will only be redeployed when we believe it can be done in a safe manner.

We will obviously no longer be using Vauld moving forward

(15 July 2022) Dezy is commencing a progressive redeployment of funds into yielders.

DeZy announced via email that it is commencing a progressive redeployment of funds into yielders. For transparency, DeZy will display all yielders used on their website and only use those which DeZy has insurance coverage for.

Haru Invest

Posted by moderator (benjamin) in the Haru Invest Telegram channel:

Haru has a different business model compared to Celsius. Haru is algorithmic trading based and Celsius being borrow-lending business model, as funds are managed in-house and by our trading teams & partners, we have significantly lesser counter-party risk than lets say, Celsius, which has liquidity locked up else where, in this case stETH

As mentioned by Haru’s CEO Hugo, “We don’t entrust any crypto asset in other DeFi or CeFi platforms, like Anchor protocol. All your crypto assets are managed directly by our in-house trading teams and our trusted partners. All our partners have gone though thorough due diligence.”

Our trading and investment strategy remains confidential for competitive advantage. However, Haru’s CEO Hugo shared some short insights into how we generate our yield. Eg. In derivative exchanges, we focus on the gaps and differences of perpetual futures and funding fee.

(1 July 2022) Statement by Haru Invest CEO Hugo Lee

“Haru Invest isn’t like other CeFi platforms out there. We do not operate as a lending model. We generate and distribute earnings through mid to high frequency algorithmic trading with risk-averse strategies. Having started with arbitrage on price gaps between spot exchanges, we now exploit the gaps and inefficiencies between crypto derivative exchanges. We have developed and tested and will continue to test new strategies that will generate stable earnings for all our members.”

“I’d like to strongly highlight that we do not allocate your assets in any other CeFi or DeFi platforms and we will continue to do so. We have never relied on Anchor Protocol, Lido, nor any stETH leverages. All your assets are managed directly by our strong in-house trading team and trusted global partners.* Hence, the collapse of UST and stETH depeg did not impact us in any way. We are still performing at the level we’ve always operated at, regardless of market fluctuations.”

KuCoin

(2 Jul 2022) KuCoin CEO dismisses rumors of halting withdrawals, reserves right to legal actionJohnny Lyu, the CEO of KuCoin, tweeted that KuCoin “does not have any exposure to LUNA, 3AC, Babel, etc.” He also added that the company had no plans to halt withdrawals and that KuCoin was operating well.

Midas.Investments

On 27 December 2022, Midas.Investments sent out an email announcing the closure down of the platform as a fixed yield CeFi platform with a 50 million deficit on their books. Many clients are set for a loss.

In the spring of 2022, the Midas DeFi portfolio suffered a cumulative loss of 50 million dollars (20% of $250 million AUM). After Celsius and FTX events, the platform experienced over 60% of AUM being withdrawn, creating a large asset deficit. Based on this situation and current CeFi market conditions, we have reached the difficult decision to close the platform.

…

Key points:

- Midas will not stop withdrawals

- Midas positions are liquid

- Midas portfolio is in full de-risk mode for weeks

Expand for full statement on 13 Jun 2022

One of our main yield competitors Celcius [sic] got caught in illiquid positions with their stETH and long-term loans and was forced to stop withdrawals for its users.

A few things I want to clarify:

Midas will not stop withdrawals.

This is your money. All withdrawals are processed accordingly. Keep in mind that we do not hold our assets on withdrawals wallets, otherwise it would be impossible to generate yield. Therefore, it can be delays in withdrawals. It is normal thing, but Midas will increase the amount of funds on our withdrawal wallets to fill the needs of everyones [sic].

Midas positions are liquid.

The current portfolio consists from liquid pools and algorithmic strategies. The only illiquid position in our portfolio is a Maven11 USDC pool on Maple finance, but it does not have more than 5% allocation in it.

Midas portfolio is in full de-risk mode for weeks

While the market suffers, our main priority is in safety of users funds. We have exited all that could be depeged (algo and synthetic stables and assets, like stETH). Most of the yields are coming from algorithmic part of portfolio, that loves volatility, and Midas swap, which fees are sustaining our business model.

Midas is building the new way of yield generation

We have trend algorithms prepared to notify us for the next opportunity for market reverse. It will open the next risk echelon of the strategies with higher yield.

Meanwhile, we are working to make some of our investment strategies open and accessible to everyone. There will be long, neutral and short strategies that you can enter and exit anytime, earning yields and upside on each market condition.

Midas long-term vision is to become the main CeDeFi platform of the crypto market, and ultimately the biggest crypto-financial platform that generates wealth.

We are using this bear market to deliver something unique to the world. Stay tuned.

“Midas has the different model of fixed yield than lending services. We are the combination of the low-risk liquid protocols like convex pools, which covers most of the yields, and algorithmic CeFi and DeFi strategies that generates the upside to finance the rest of the yields + Midas buybacks.”

Expand for more

A lot of our competitors are struggling through this market conditions. The business model of such CeFi lending services is highly illiquid and motivated to search opportunities to resell the interest rate to third parties that pays more than what they pay to investors.

It seems that 3AC was one of the core borrowers from every lender of the market with a heavy bet on Luna and UST. The Luna crash event triggered the house of cards, where the risk of lenders was accumulated in one place without them knowing it.

Midas has the different model of fixed yield than lending services. We are the combination of the low-risk liquid protocols like convex pools, which covers most of the yields, and algorithmic CeFi and DeFi strategies that generates the upside to finance the rest of the yields + Midas buybacks.

This combination allows us to sustainably and safely generate yield on DeFi, while profiting from volatility, liquidation, and even flat market conditions. Basically, we are combining best practices of asset management with the CeFi platform.

Every DeFi position has alerts that tracks liquidity imbalances in pools. Additionally, our trending algorithms help us to allocate the trends, which gave us the upper hand in de-risking our portfolio back in February.

…

“I am sorry for everyone who have been using Hodlnaut and whose funds got stuck. It is irresponsible from Hodlnaut team to continue operate after they were exposed to UST and lie to users about this.”

“I want to stay clear, that our risk frameworks did not allow Midas to invest in UST and stETH (and many other protocols), which allowed us to not have losses during May and June events. Therefore, we never had plans to close withdrawals or even put a lock-up periods."

“In two months we have done an incredible work on pivoting Midas towards CeDeFi, and we are happy with the feedback we are receiving so far.”

“I have no doubts that Midas will prevail on top of the ashes of CeFi platforms. If the launch of CeDeFi strategies will be a success, Midas has decent chances to become the key wealth management platform in financial sector in the next ten years.”

“Thank you for staying with Midas for those five amazing years.”

Nexo

Nexo proposed to buy-out Celsius Network.

(20 Jun 2022) Shared on Twitter:After what appears to be the insolvency of @CelsiusNetwork and mindful of the repercussions for their retail investors & the crypto community, Nexo has extended a formal offer to acquire qualifying assets of @CelsiusNetwork after their withdrawal freeze. https://t.co/JFtKTHRLcY

— Nexo (@Nexo) June 13, 2022

“A principle we’ve adhered to since day one. No entity, be it a person or an institution, will receive credit from us without sufficient backing that fulfills our strictest collateralization requirements.”

#NexoFundamentals: Overcollateralization ⚓

— Nexo (@Nexo) June 20, 2022

A principle we’ve adhered to since day one. No entity, be it a person or an institution, will receive credit from us without sufficient backing that fulfills our strictest collateralization requirements.https://t.co/BSjmb1c7oU

StableHouse

(15 Jun 2022) Email from StableHouse:Hey All,

Given the current market context, we feel it’s important to provide a perspective on StableHouse and our view of what’s happening.

At StableHouse, we exist to help new, savvy investors achieve financial growth through crypto, with the stability and security of traditional finance.

To achieve superior risk-adjusted returns, we believe the crypto industry needs to operate with the same rigorous risk management and investment principles seen in traditional finance.

For StableHouse this means:

- Ensuring extensive due diligence and risk assessment are undertaken for every investment and counterparty

- maintaining a diversified portfolio of investments and counterparties

- Partnering with the right regulatory body to offer a recognised and credible offering, the Bermuda Monetary Authority (Why the BMA)

- Capitalizing on crypto’s ability to be a superior source of collateral to back investments

StableHouse was founded by XBTO group, a leader in cryptofinance who shares our vision in making crypto everyday finance.

Our new members currently have to enter a waitlist, as our current license from the BMA limits the pace of our user and asset growth. We are fortunate to reap this benefit of steady, sustainable growth while we are in the final stages of obtaining our full license.

We started StableHouse with a simple, yet compelling vision: to empower the new generation of investors to benefit from the new world of finance. So everyone can benefit from a future of digital currency in a regulated setting. Our vision is timeless across all market conditions.

Please don’t hesitate to reach out to us at support@stablehouse.io if you have any questions.

Thank you, The StableHouse Team

Tokenize Xchange

(14 Jun 2022) Email from Tokenize Xchange:Dear Valued Users,

In view of the recent market volatility, Tokenize Xchange remains unaffected and all of our products and services are still fully operational, including our Crypto/Dual Earn Programmes, trading pairs, deposits and withdrawals.

Your security is our utmost priority and we pride ourselves on making our platform safe and secure.

Please rest assured that we have strict risk management policies in place and do not have any dealings with Celsius or any other DeFi protocols.

Additionally, it has always been a consistent Tokenize Xchange policy for having fiat and crypto withdrawal limits based on each user’s memberships.

Kindly refer here for more details - https://tokenizexchange.zendesk.com/hc/en-gb/articles/5953941687705-Withdrawal-Fee-Limit

If you have any further enquiries, please feel free to reach out to the Tokenize Xchange team at support@tokenizexchange.zendesk.com.

To Trading Success, The Tokenize Team

YouHodler

(15 Jun 2022) Email from YouHodler:Too long to paste the entire email but key points are:

“To this day in all times of YouHodler’s existence, we have never blocked any withdrawals and are not planning to. Every transaction has been executed and we will not try to convince our clients to keep their funds. We don’t have any sales managers to chase the users and we have everything transparent on our platform. If our users want to withdraw, they can do that in fiat or crypto.”

“We are not exposed to a similar situation as Celsius is right now. We never participated in any liquidity pool or DeFi protocols, moreover, all our users' funds are always inside the platform. We have more than enough liquidity to cover any possible transactions or withdrawals.”

“We are European regulated company, and all our users are protected by European law.”

All these points and even more will be addressed by CEO Ilya Volkov during a AMA (Ask Me Anything) session hosted by CoinTelegraph.

(23 Jun 2022) YouHodler vs Celsius Network: A Comprehensive ReviewYouHolder published a blog comparing themselves against Celsius Network.