Finblox Review, Notes, and Referral Benefits

URGENT UPDATE!!!

I received this email from Finblox on 16 June 2022, 830PM Singapore time

To our Valued Users,

We have been closely monitoring market conditions and numerous media reports regarding a prominent institutional borrower, Three Arrows Capital (3AC) - who is also an investor in Finblox.

We have been cooperating with over 8 partners and protocols, including 3AC, to generate yields and spread the risk as evenly as possible. Based on currently available information and our priority to maintain the integrity of the platform - we have decided to take the following actions while pursuing all available options to evaluate the effect of 3AC on the liquidity, and ensure fair treatment of all user assets in the system:

- Pause reward distributions on the Finblox platform for all users

- Change withdrawal limits (500 USD equivalent per day, up to a maximum of 1500 USD equivalent per month) for all levels of users

- Delay referral program and deposit rewards

- Disable creation of crypto addresses for newly registered users

This set of actions is a necessary move in such a highly volatile market and we believe should help us and our community to manage the effect.

Ultimately, Finblox will do everything in its power to protect our users’ funds and reinstate our services in full. We will provide you with updates and inform you of any new developments as soon as possible, and do all that we can to avoid further impact on our users.

Thank you for your understanding, The Finblox Team

I tried withdrawing 499 USDC via BSC network on three occasions (17-19 June 2022) and all the transactions went through within 30 mins without any hitches.

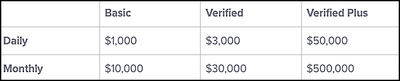

As of 24 August, withdrawal limits have improved. Complete details can be found on the withdrawal limits article

- daily limits refresh every day at 00:00 UTC, while monthly limits refresh every first calendar day of the month at 00:00 UTC.

- note that effective 3 August 2022, users must pay a fixed fee for each withdrawal in order to cover the fees associated with transferring cryptocurrency out of their Finblox account. Details on withdrawal fees available here

I am following the social media discussions and official announcements to gather more information. Removing the referral link from this page till there is more clarity on the situation.

Further updates to the situation can be found here.

Table of Contents

Company

“We’re on a mission to democratize wealth building for all.”

Launched in December 2021 and based out of Hong Kong, Finblox Ltd is a venture-backed crypto savings startup with remote teams in Vietnam, Russia, Indonesia, Hong Kong and Singapore.

Finblox offers one of the highest interest rates in the digital assets space. It offers up to 90% yield on cryptocurrencies such as Bitcoin, Ethereum, Solana, Avalanche, and Axie Infinity tokens. Users on the platform can earn a 15% annual percentage yield on USD Coin (USDC).

The platform also has no limits on minimum balances or withdrawal periods.

Note:

“Finblox is not a bank nor a deposit account, nor is it a depository institution, custodian, fiduciary, or any other type of asset account characterized as a banking product or service.”

Business model

The company generates yield on tokens through a range of strategies, including lending out the assets to financial institutions, delegated staking, and use of DeFi protocols.

Finblox takes a cut on the interests it earns.

![Distribution of assets under managements [Jul 2022]](/platform-hodl/finblox/finblox-aum-distribution_hu6a617c4909dd7adf3f1eab592c14bb3b_28767_17ecf2dc8c747a50ee9db3846d150a91.jpg)

Yield strategies

Based on a transparency report released in July 2022:

- No leveraging or other CeFi yield platforms will be used.

- Allocation targets/limits (subject to revision and periodic change):

- Self custody: 5-15%

- Centralized exchange: 25-50%

- CeFi platforms: 0%

- DeFi protocols: 40-65%

![Target asset allocation rates [Jul 2022]](/platform-hodl/finblox/finblox-target-asset-allocation-jul-2022_hu4863edbfb1d1fc17bfd4dfb67311d64d_37050_abad6b84f2edbda90ae80337e1686cb8.jpg)

Stablecoins:

- Most stablecoins will be deployed to brand name, high volume centralized exchanges for margin lending yield, with some assets deployed to Curve.fi, Yearn.Finance, and PoolTogether. The ratio of assets will vary with yield generation.

Other altcoins:

- All non-stablecoin assets will be deployed across a greater number of protocols. These include, but are not limited to:

- Delegated staking

- Liquidity pools - deploy to LPs which we assess as low impermanent loss risk pairs.

- Centralized exchanges - Qualified tokens will be deployed for yield/staking.

- No leveraging or other CeFi yield platforms will be used.

Earning rates

Prevailing interest earning rates listed here.

Investors

Finblox is backed by top-tier investors:

- raised US$3.9 million in a funding round within just 4 months of launching [Mar 2022]

- investors include Dragonfly Capital, Sequoia Capital India, Saison Capital, Three Arrows Capital, MSA Capital, Coinfund, Venturra Discovery, Kyros Ventures, First Check Ventures, Ratio Ventures and other angel investors

- raised an undisclosed seven-figure amount [Dec 2021]

- from Sequoia Capital India, MSA Capital, Venturra Discovery, Coinfund, Saison Capital, Ratio Ventures, and First Check Ventures.

Notable developments

- ‘FinEarn’ product was added to the Suspected Unauthorised CIS Alert List of the Securities and Futures Commission (SFC) [14 Dec 2022]

- announced the launch of FinSwap [Aug 2022]

- allows seamless exchange one crypto for another without leaving the platform

- only available on mobile app currently

- published litepaper and announced plans to launch FBX governance token [Jul 2022]

- announced following measures due to unfolding situation with Three Arrows Capital (3AC) [16 Jun 2022]

- pause reward distributions on the Finblox platform for all users

- change withdrawal limits (500 USD equivalent per day, up to a maximum of 1500 USD equivalent per month) for all levels of users

- delay referral program and deposit rewards

- disable creation of crypto addresses for newly registered users

- launch of platform [Dec 2021]

Presence in Singapore

Unknown

Regulatory Compliance

Monetary Authority of Singapore (MAS)

Unknown

Other Regions

On 14 December 2022, the ‘FinEarn’ product was added to the Suspected Unauthorised CIS Alert List of the Securities and Futures Commission (SFC).

The investment arrangements included in the alert list have come to the SFC’s attention through enquiries or complaints. They display certain characteristics of a “collective investment scheme”(CIS) as defined under the Securities and Futures Ordinance (SFO). As they are not authorised by the SFC, they may not be offered to the Hong Kong public.

The SFC is an independent statutory body set up in 1989 to regulate Hong Kong’s securities and futures markets.

Risk disclosure

Finblox’s risk disclosure document can be found here. Please read in detail.

Some extract (based on document version on 16 June 2022):

Finblox deploys Digital Assets held by it in a variety of income-generating activities, including lending them to third parties and transferring them to external platforms and systems. Finblox conducts in-depth due diligence analysis of any such third party or platform, including security, financial and credibility tests. However, Finblox can not guarantee that they shall not suffer any breaches, lose such Assets, or will be able to return any and all Assets to Finblox, resulting in loss of the Assets.

By engaging with Finblox you thus acknowledge that there is a risk that Finblox may become unable to return the Digital Assets to its users, in which case your Digital Assets may be lost, in whole or in part, and for such loss, Finblox shall not be liable.

Social media

Transparency

Finblox started publishing monthly transparency reports from July 2022 onwards, which is designed for users to know where funds are being deployed.

Archive:

Ecosystem

Access to platform

- mobile app

- webapp

- launched in June 2022

Finblox University

“We don’t teach you how to trade - we teach you how to save.”

Finblox University offers free educational resources on a variety of crypto-related topics including fundamentals, projects, and advanced concepts.

Vaults

Crypto vault

This vault is designed for those who enjoy earning on more volatile assets such as BTC, ETH, SOL, AXS, AVAX, and more.

Savings vault

Stablecoin vault designed to help clients enjoy outstanding but consistent yields that come from DeFi lending markets.

✔️ Unique Selling Proposition (USP)

Interest paid in-kind

Interests are paid out in the same crypto asset deposited.

Interest paid out daily

At Finblox, interest is paid out every 24 hours, based on the balance in your account that existed 24 hours ago.

This means if you have made a new deposit (or added to an existing balance), that amount will not count towards accruing yield until it has been in the account for at least 24 hours.

No lock-ins

Users are free to withdraw from Finblox at any time.

Security and insurance on assets

At Finblox, user assets are secured by Fireblocks Inc. (“Fireblocks”), a SOC 2 Type II certified digital assets custodian with bank-grade security.

Crypto insurance platform Coincover also protects the platform. There is a 45 million insurance on assets as of May 2022. The insurance only covers technical malfunctions and hacks within the Fireblocks system.

Wide blockchain network support for stablecoins like USDC

Finblox supports a variety of blockchains for easy deposit of stablecoins like USDC and USDT.

For USDC, blockchain networks supported include Ethereum (ERC-20), Solana (SPL), BNB Smart Chain (BEP20), and Polygon.

For other crypto assets, check the list of supported blockchains here.

Usage Notes and Tips

Account opening

Account opening was quick, I just signed up with an email.

- faced an issue in the Android app where I was only allowed 16 characters for entering my full name.

- check the ‘Junk’ folder for the OTP sent to verify your email address

- the KYC service provider is ‘samsub’. They are very efficient and my KYC was completed within minutes.

Supported countries

Finblox’s services are available in over 100 countries. The list of countries Finblox does not support can be found here.

XSGD

Surprisingly Finblox pays a pretty good yield on XSGD, the stablecoin backed by Singapore dollars. This is quite rare.